Investing is often seen as something only the wealthy can afford, but even with a small amount of money, you can begin your journey to financial growth. This guide will walk you through how to start investing with limited funds, helping you take that crucial first step towards a secure financial future.

Table of Contents

- 1. Why Start Investing?

- 2. Set Your Financial Goals

- 3. Types of Investments for Beginners

- 4. How to Start Investing with Small Amounts

- 5. Choosing the Right Investment Platform

- 6. Managing Risk

- 7. Take a Long-Term Approach

- Conclusion: Start Small, Grow Big

1. Why Start Investing?

Investing allows you to grow your money over time, giving you financial security and a pathway toward long-term goals. Even a small amount invested consistently can multiply due to compound interest, making it a great choice for those aiming to build wealth gradually.

2. Set Your Financial Goals

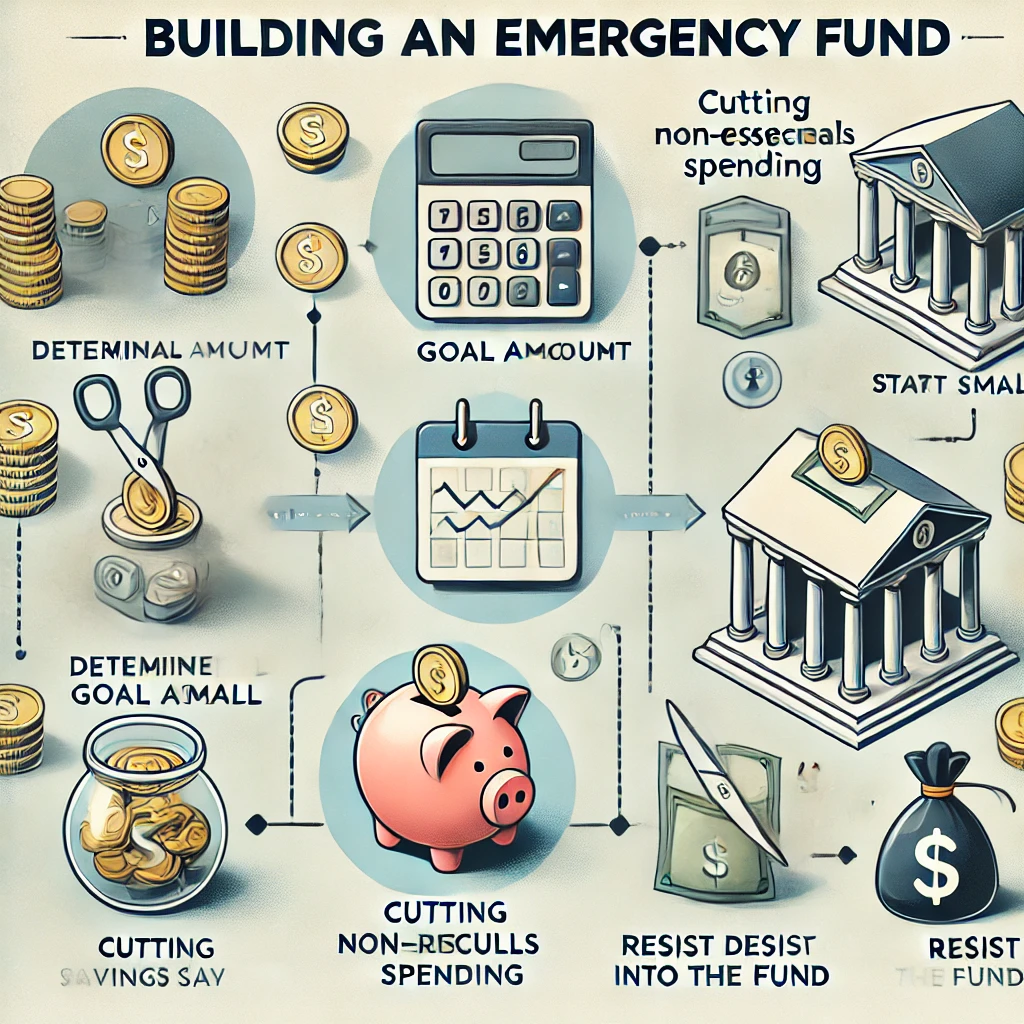

Before investing, define what you want to achieve. Are you saving for retirement, a big purchase, or building an emergency fund? Clear goals help you choose the right investments that align with your timeline and risk tolerance.

- Tip: Write down your short-term and long-term goals. This can keep you motivated and focused on your investment strategy.

3. Types of Investments for Beginners

For beginners, some low-cost and accessible investment options include:

- Stocks: Buying shares of companies allows you to own a portion of the business and grow your wealth as the company grows.

- Exchange-Traded Funds (ETFs): ETFs are funds that hold a variety of stocks or bonds, offering diversification and lower risk compared to individual stocks.

- Mutual Funds: These are professionally managed portfolios of stocks or bonds that pool money from multiple investors.

- Robo-Advisors: Automated investment platforms that provide low-cost, diversified portfolios tailored to your risk tolerance and goals.

4. How to Start Investing with Small Amounts

You don’t need a lot of money to begin investing. Many platforms allow you to start with as little as $5 or $10. Here are a few ways to start small:

- Fractional Shares: Some platforms offer fractional shares, enabling you to buy a portion of a stock instead of the whole share, making it affordable.

- Micro-Investing Apps: Apps like Acorns and Stash allow you to invest small amounts and round up your everyday purchases to invest spare change.

- 401(k) Plans: If your employer offers a 401(k) with matching contributions, take advantage of it. Even small contributions can grow significantly over time.

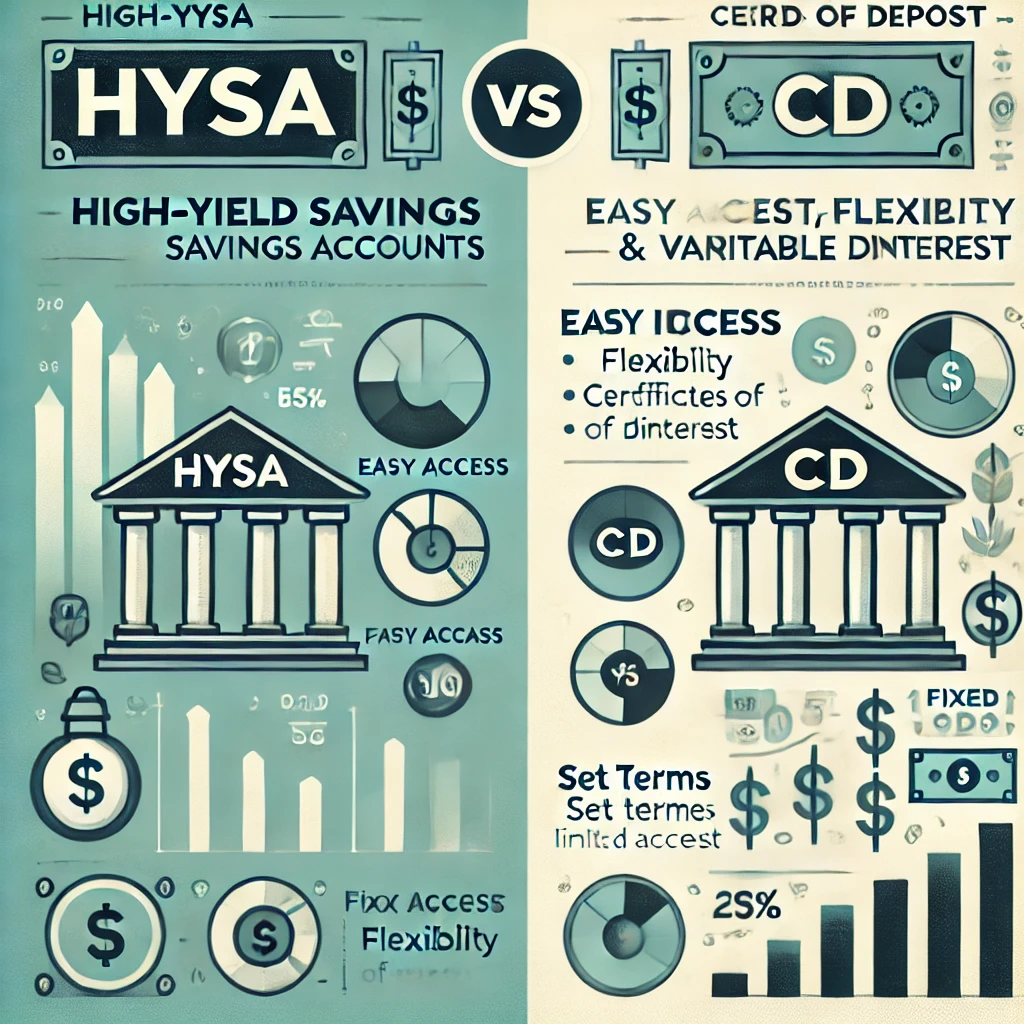

5. Choosing the Right Investment Platform

Selecting the right platform is essential, especially when starting with a limited budget. Look for platforms with low fees, no account minimums, and the ability to buy fractional shares or invest small amounts. Some popular beginner-friendly platforms include Robinhood, Fidelity, and M1 Finance.

- Tip: Compare fees, ease of use, and investment options to find a platform that aligns with your financial goals.

6. Managing Risk

Investing always carries some level of risk, but with proper management, you can protect your money. Diversify your investments by spreading them across different assets, such as stocks, bonds, and ETFs. This reduces the impact of any one investment performing poorly.

- Tip: Avoid putting all your money into a single investment, especially when starting out. Diversification is key to reducing risk.

7. Take a Long-Term Approach

Investing is not a get-rich-quick scheme. Markets can be volatile, and prices fluctuate in the short term. However, a long-term approach allows your investments to grow and benefit from compound interest, making it easier to achieve your goals.

- Tip: Avoid the temptation to sell during market dips. Consistent investing over time helps maximize returns.

Conclusion: Start Small, Grow Big

Starting to invest with little money may seem challenging, but with the right approach, it’s entirely possible. Begin by setting clear financial goals, choosing low-cost investment options, and sticking to a long-term strategy. Remember, every small investment contributes to your financial future. With patience and consistency, you can build wealth and achieve financial security.

Have additional tips for beginner investors? Share them in the comments below!